January 2026 Trading Activity Accelerates as Volatility Takes Over

January didn’t wait around.

Markets reopened with movement, not hesitation.

From precious metals to major currencies, price action widened fast, volatility returned, and traders jumped back in earlier than expected. The D Prime January 2026 trading volume captures that energy clearly, showing how a volatile start helped keep trading momentum alive in the very first month of the year.

And the moves were anything but subtle.

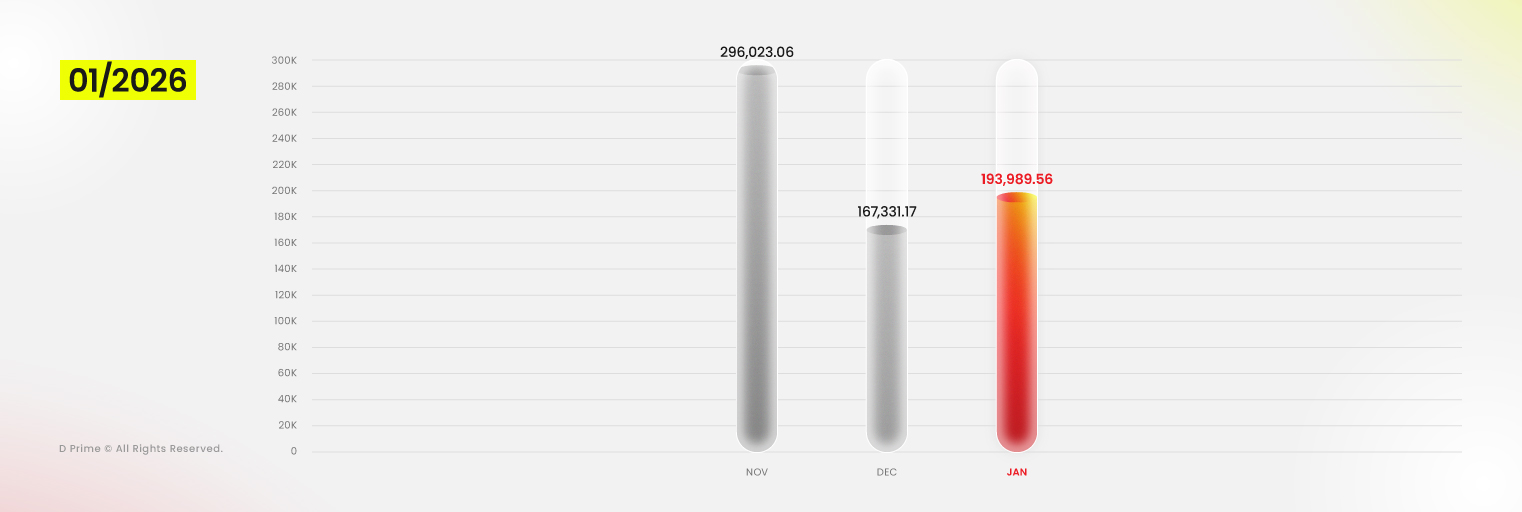

Key Trading Volume Highlights January 2026

- Total trading volume: USD 193.99 billion (+3.77% MoM)

- Average daily volume: USD 6.26 billion (+3.77% MoM)

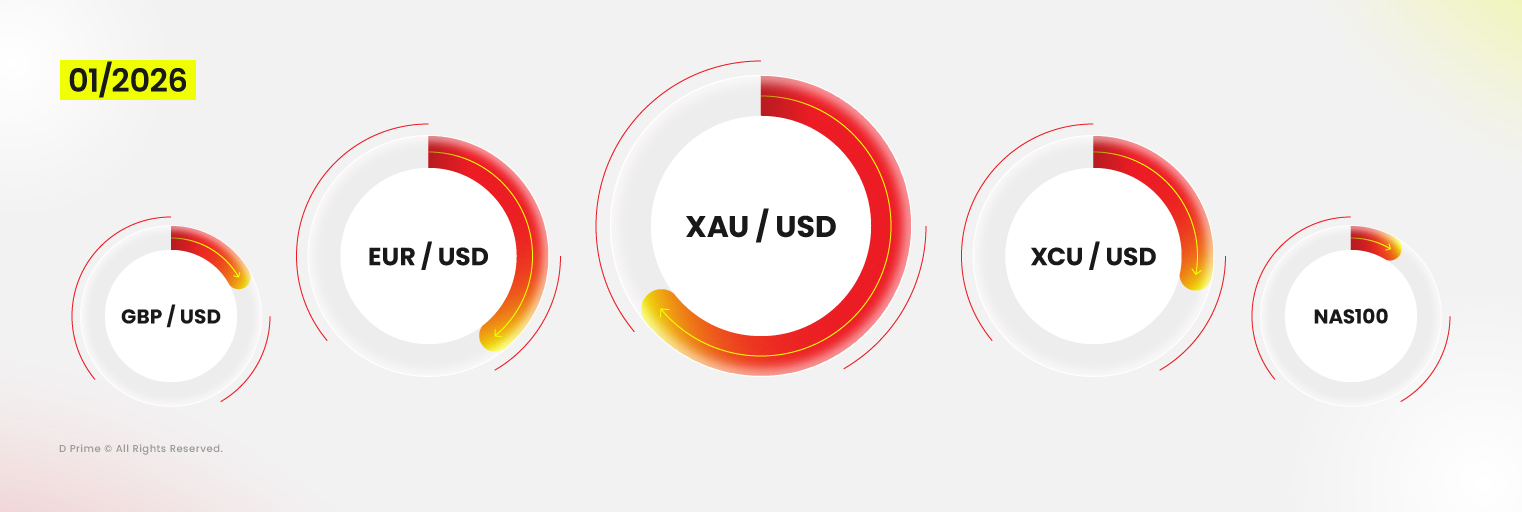

- Top traded products: XAU/USD, EUR/USD, XCU/USD, GBP/USD, NAS100

- Largest volume increase: XAU/USD (+USD 4.348 billion)

- Fastest growth: XAG/USD (+147.22%)

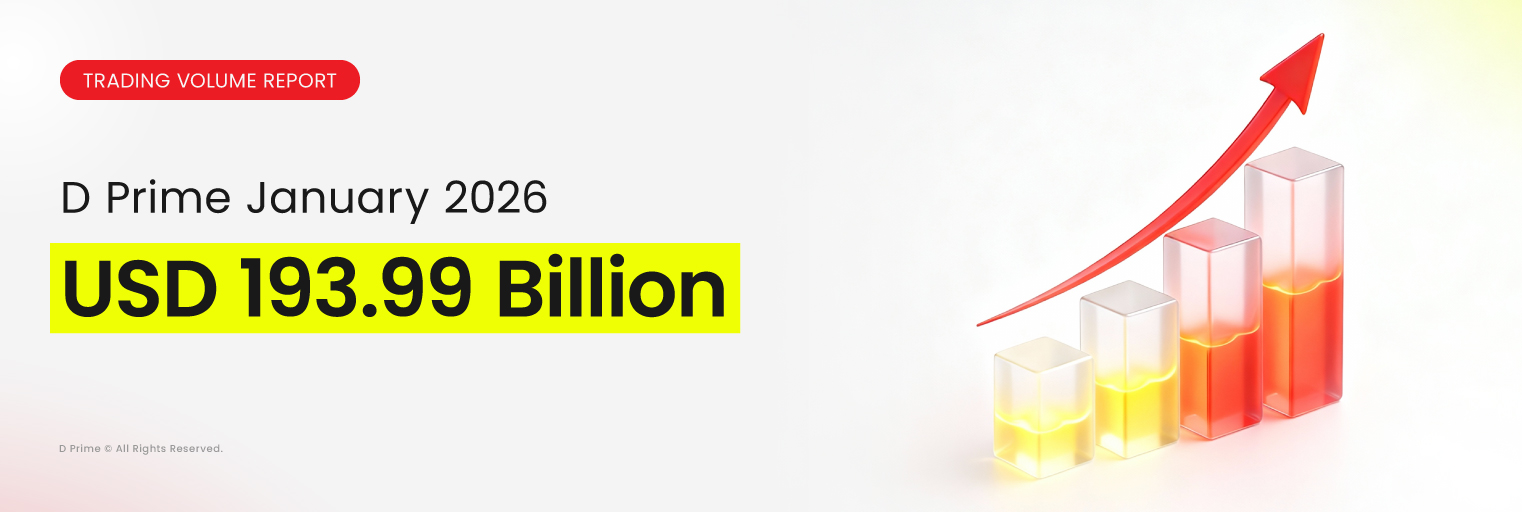

D Prime Trading Volume Report – January 2026: USD 193.99 Billion

In January 2026, D Prime recorded a total trading volume of USD 193.99 billion, marking a 3.77% increase from December. Average daily volume (ADV) rose to USD 6.26 billion, as traders returned from the year-end reset and began positioning early for what 2026 might bring.

Instead of easing into the year, markets forced engagement.

The reason? Uncertainty showed up fast.

When Volatility Shows Up Before Clarity

January’s market mood was tense.

The Federal Reserve’s decision to pause interest rate cuts at the January FOMC meeting, combined with unexpected leadership nomination developments, unsettled expectations almost immediately. Traders weren’t given time to settle into a narrative.

Prices started moving first.

Volatility spread across gold, silver, industrial metals, and major indices, keeping traders active even as policy direction became harder to read. That mix of uncertainty and opportunity helped sustain trading participation across the platform.

Gold Takes Control of the Story

If January had a headline market, it was gold.

Throughout the month, XAU/USD delivered sharp, emotional price action. Gold opened near USD 4,318 per ounce, then powered higher, breaking above the USD 5,000 psychological level on January 26.

Momentum peaked on January 29, when gold hit a historic high of USD 5,598.75 per ounce.

Central bank buying, rising geopolitical risk, and expectations of prolonged policy easing all fed the rally.

Then the tone flipped.

Gold didn’t just rally. It sent a message.

Read our full breakdown on what gold above USD 5,000 says about the US dollar:

Gold Breaks $5,000: Cracks in US Dollar Dominance

One Day That Changed Everything

On January 30, gold prices collapsed.

Intraday losses reached 12.92%, briefly pushing prices down to USD 4,682 per ounce. Markets reacted sharply to news that Donald Trump nominated former Federal Reserve Governor Kevin Warsh as the next Fed Chair, raising fears of a shift in future monetary policy.

Add a technical unwind from overbought levels, and the result was historic.

Gold closed the day down 9.25%, its sharpest single-day drop since April 1980. Prices later stabilized and ended the month around USD 4,880 per ounce.

For traders, this wasn’t chaos.

It was opportunity.

Why XAU/USD Dominated January’s Volume

That surge, collapse, and rebound created exactly what active traders look for: range.

Wide ranges demand decisions.

And in January, traders made plenty.

As a result, XAU/USD recorded the largest increase in trading volume, rising USD 4.348 billion compared with December and becoming the biggest contributor to the month’s overall growth.

Gold didn’t just move.

It pulled the market with it.

The Momentum Spreads Beyond Gold

D Prime Trading Volume Report – January 2026: Top Traded Products

January wasn’t a one-market story.

Alongside gold, EUR/USD, XCU/USD, GBP/USD, and NAS100 ranked among the most actively traded products. Safe-haven assets, major currencies, industrial metals, and equity indices all stayed in focus as traders looked to balance risk and opportunity.

But one market surprised almost everyone.

Silver Breaks Out

XAG/USD emerged as January’s most explosive mover.

Trading volume in silver jumped 147.22%, making it the fastest-growing product of the month. Silver’s close link to gold amplified volatility, while improving industrial demand from sectors like electronics and photovoltaics supported physical interest.

Layer in accommodative liquidity conditions and rising safe-haven demand, and silver suddenly became impossible to ignore.

Its price action mirrored gold’s surge and pullback — just with more intensity.

For short-term traders, that mattered.

What January’s Trading Volume Really Tells Us

The rise in D Prime January 2026 trading volume wasn’t driven by optimism alone. It reflected a market reacting to movement, not certainty.

January rewarded adaptability.

Gold delivered momentum.

Silver amplified volatility.

Currencies, metals, and indices offered balance.

Instead of waiting for clarity, traders leaned into action.

Starting 2026 in Motion

January set the tone. Fast, volatile, and engaged.

As markets move deeper into 2026, attention will remain on the Federal Reserve’s next steps, leadership developments, and how geopolitical risks continue to shape sentiment across asset classes.

At D Prime, supporting traders through every market phase remains the focus. Whether navigating sharp rallies, sudden reversals, or moments of pause, D Prime continues to provide deep liquidity, reliable execution, and access to opportunities when markets move.

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks.

Disclaimer

This article may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

This information contained in this blog is for general informational and educational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance and D Prime and its affiliates give no assurance that any views, projections, or forecasts will materialize.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial trading or investment decisions.

“D Prime” is a brand name of D Prime Vanuatu Limited, a company incorporated and regulated by the Vanuatu Financial Services Commission (Company Number: 700238). The availability of products and services may vary depending on jurisdiction and applicable regulatory requirements.